Nevada County Sales Tax

Pay Taxes - Elko County, Nevada

Elko County Treasurer 571 Idaho Street, Suite 101 Elko, NV 89801 Enter your parcel number or personal property account number in the account number field, including hyphens, example 001-002 …The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax …

Trustee Property Sale - Elko County, Nevada

If interested in joining our distribution listing for future tax sales, please send an email to www.semadata.org with your First and Last Name and your email address. All properties listed on the Delinquent Tax Auction list were previously deeded to the Elko County Treasurer as trustee for the county and will be sold at public auction.Nevada Income Tax Calculator - SmartAsset

Jan 01, 2020 · Of course, you must still pay federal income taxes. Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates for every county and the largest cities in … bread wallet support phone numberNevada County residents watch Nevada City, Grass Valley ...

Holler noted that the city had received no complaints of mischarged sales taxes since the new tax rate took effect, but Tina Vernon, Nevada County’s treasurer-tax collector, said her office has received a nevada county sales tax few complaints in both new taxes’ first week, even though her office has nothing to do with sales taxes.Tax Auction - Washoe County, Nevada

Tax Auction The Washoe County Treasurer’s Office holds auctions for delinquent property and mobile home taxes. Nevada State Law provides for the redemption of real estate properties up until 5 pm on the third business day before the day of the sale by a county treasurer (NRS 361.585).Clark County, NV

How does the term "assessed value" relate to tax dollars? All property tax exemptions in Nevada are stated in "assessed value" amounts. The nevada county sales tax term "assessed value" approximates 35% of the taxable value of an item. The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County.California City & County Sales & Use Tax Rates

Current Tax Rates, Tax Rates Effective October 1, 2020, Find a Sales nevada county sales tax and Use Tax Rate by Address, Tax Rates by County and City, Tax Rate Charts, Tax Resources, The following files are provided to download tax rates for California Cities and CountiesRECENT POSTS:

- louis ck stand up full

- las vegas premium outlets shoe stores

- outlet louis vuitton enveloppe carte de visite m64021 taiga leather

- dior tote bag vs lv on the gold

- louis vuitton kirigami pochette small

- speedy louis vuitton 35 cm

- black friday 2020 walmart deals

- saint laurent outlet stores usage

- lv desert boot sizing

- coupon for skypark st louis

- chanel classic crossbody bag

- louis vuitton coin purse for sale

- rolling duffel bag with backpack straps

- apply for speedy cash installment loans

no FX fee credit cards

Purchasing a handbag in a foreign currency typically leads to a currency conversion charge of 2-3% by your bank/credit card provider. As such, make sure to use a no foreign exchange fee credit card (if possible) to avoid this charge.

vat/gst refunds

VAT (Value-added Tax)/GST (Goods and Services Tax) are particularly high in Europe, ranging between 15-25%. If you are a visitor to the EU, you are likely to be able to claim back the VAT which would be a huge saving! Similar refund options are provided in many other countries around the world. Inquire with the retail store directly on the process. Most will use the services of Global Blue or a similar tax refund company.

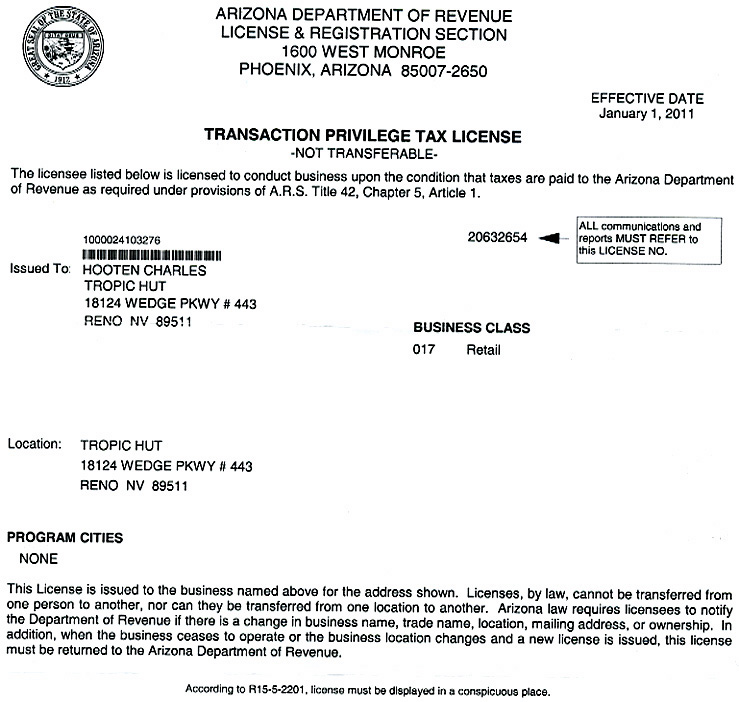

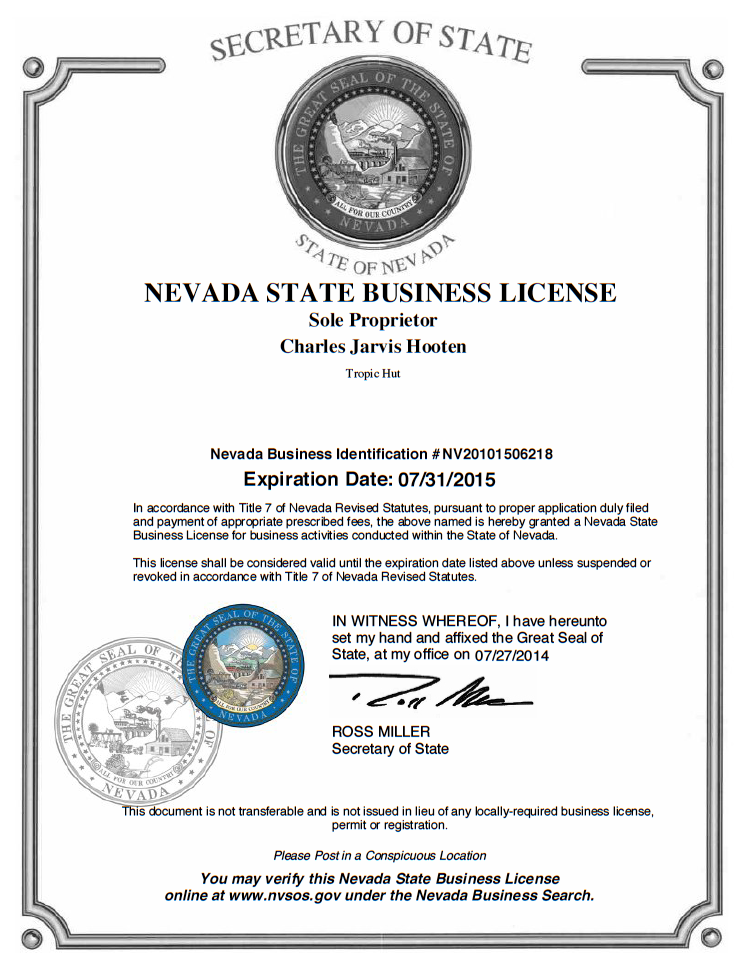

USA / Canada sales taxes

Be aware of retail prices in the USA and Canada. In these countries, sales tax is added to the advertised handbag price (varies by province/state/region e.g., 8.875% in New York City). This in contrast to most other countries where taxes are already included in advertised retail prices.